Crypto30x.com Bitcoin: Insights, Analysis, and Market Trends

Cryptocurrencies remain fairly volatile which makes the year 2024 an important one for experienced investors and beginners. During this growth, the skill of the strategic management of profits is necessary to achieve profits. They offer a clear, detailed system for approaching the crypto market with an eye toward taking profits in the most effective manner possible. Choosing the objectives, using sound technical and fundamental analysis and having strong discipline one can feel confident while trading in the sphere of crypto30x on any trading platform.

Crypto30x.com Bitcoin

Knowledgeable about a specific market that has bull and bear stages is a useful step if one needs to exit at a specific time. Having realistic targets cut off for promotional profits in terms of percentages, monetary values, and technical analysts is very useful. Using the moving average, oscillators like RSI, and the MACD in TA, as well as using fundamental parameters like market capitalization, trading volume, and the volume of ongoing development makes decisions more effective.

These measures are policies that act as shields against loss; diversification, stop loss orders, position sizing. The specific timing of exits together with other strategies such as scaling out and trailing stop- loss order enhance maximum profitability. Forcing yourself through key influencer accounts and engaging in online communities helps you to be on the up-to-date on market trends. When combined with these approaches, you can hope for outcome-driven sustainability in the volatile cryptocurrency space. To learn more about where you should be directing your investment dollars, please see our list of the best cryptocurrencies to buy today. You can also go through the list of the best bitcoin casinos in Australia for 2024 and start an unforgettable gambling extraordinaire.

Understanding Market Cycles

The process is followed by the accumulation phase which happens after the drop in market so that wise investors start to get assets at cheaper prices expecting them to rise in the future. This moves up into an upward trend that is depicted by enhanced prices, growing confidence of investors and enhanced trading activity. During distribution phase the holders of earlier issued equities put them in the market and this leads to more swings of the market indicating that the market may be reversing. Finally, the downtrend phase characterized by, low prices, loss of confidence and reduced traders, bearish force liquidation through selling pressure at lower volumes.

The understanding of these phases allows the investor to the right decisions regarding investment in the market. For example, accumulation phase involves buying and distribution phase involves selling can be very rewarding. Such cycles are well evident from historical data like the rise of bitcoins in 2017 and the dramatic drop in 2018. Through such analysis, investors are able to point where these trends are heading hence setting the right market trend to cash in their stocks in a highly volatile market like the Cryptocurrency Market.

A general explanation of what market cycles mean for crypto

Fluctuations in the market involving cryptocurrencies is a situation like in the normal stock markets whereby, there is increase and decrease in economic activities from high to low and vice versa. These cycles are typically characterized by four phases: Gathering or accumulation phase, vibrant or bullish market phase, scattering or distribution phase, sluggish or bear market phase. Knowledge of these phases is important when you want to maximize on your profit taking strategies.

Accumulation Phase:

This is the period when the prices of assets level off and the intelligent investors start buying the assets at cheaper price in anticipation of an upward market.

Uptrend (Bull Market):

This phase is also associated with high level of prices and growing faith of investors and this stage is normally marked by a high increase of participants where the price shot through the roof.

Examples & Trends

Analyzing periodic market data the signs of such market cycles can be traced without any doubt. For instance, the bull market in 2017 experienced a high where Bitcoin close to $20000 and then in the following year, the bear market experience with prices low. These trends are helpful in that they allow investors to identify the general tendencies on the market and thus will be able to adjust their plans for taking profits.

Understanding Bull and Bear Markets

To determine whether the market is in a bull or a bear phase, one looks at several factors witting and market feeling. Key indicators include:

- Price Trends: Continuous oscillating movements in prices over a period.

- Trading Volume: Elevations in trading volume are likely to happen in bullish markets while declines may likely take place in bearish markets.

- Market Sentiment: Public sentiment which entails news and opinion from social media as well as word sentiment analysis tools.

Setting Profit Targets

Why SMM Needs Quantifiable Profit Goals

I agree with brockway that setting of clear profit targets prior to investments is one of the most important requirements. With no targets set, investors become vulnerable to biases which result in less than the best returns. Specific objectives especially in trading help one know when to sell, thus promoting disciplined and systematic exercise.

Ways of Setting Profit Quantifiable Goals

There are several methods to determine profit targets, including:

- Percentage-Based Targets: Adjusting for a fixed percentage above the purchase price as a goal. For instance choosing to take your money after a particular cryptocurrency has appreciated by 30%.

- Dollar Amount Targets: Picking a definitive number of dollars to make more. For example the decision to make a cut once the investment has risen to $10,000.

- Technical Indicators: For example, trading by applying Fibonacci retracement levels or resistance levels or moving averages in placing profit targets.

Objects and measurements for formulation of goals

Key tools and indicators for setting profit targets include:

- Fibonacci Retracement Levels: They are rectangles that show where the price has found support or resistance at the major Fibonacci levels before resuming the trend in its primary direction.

- Moving Averages: A trend indicator: sveiled through Simple and exponential moving averages offers an opportunity to see potential points for profit taking.

- Support and Resistance Levels: Knowing the values of support and resistance, experienced traders are able to set achievable targets of profits.

- VT for Profit Taking

- Basics of Technical Analysis

Technical analysis can be defined as the use of price charts and other markets indicators and data in order to predict the future prices. It has the basis that the past prices of the security predict the future prices of the security by mimicking their movements. Some of the sub-topics under technical analysis include; charting patterns, charting indicators, and volume analysis.

Key Indicators: Moving Averages, RSI, MACD

- Moving Averages (MA): SMA and EMA are widely applied in all markets to filter prices and determine trends. In the basic analysis moving average of 50 and 200 days is such key indicators.

- Relative Strength Index (RSI): It is an index that aims at establishingwhether the stock is over bought or over sold by comparing the magnitude of recent price changes. The value above 70 is considered an overbought level, and all values below 30 are considered as oversold level.

- Moving Average Convergence Divergence (MACD): These refer to a relationship between two lines of average of price of a particular security over again different periods of time. This indicator is reached by subtracting between 26 average holdings – exponential average of the last 26 data points- and the 12 average holding- exponential average of the last twelve data points.

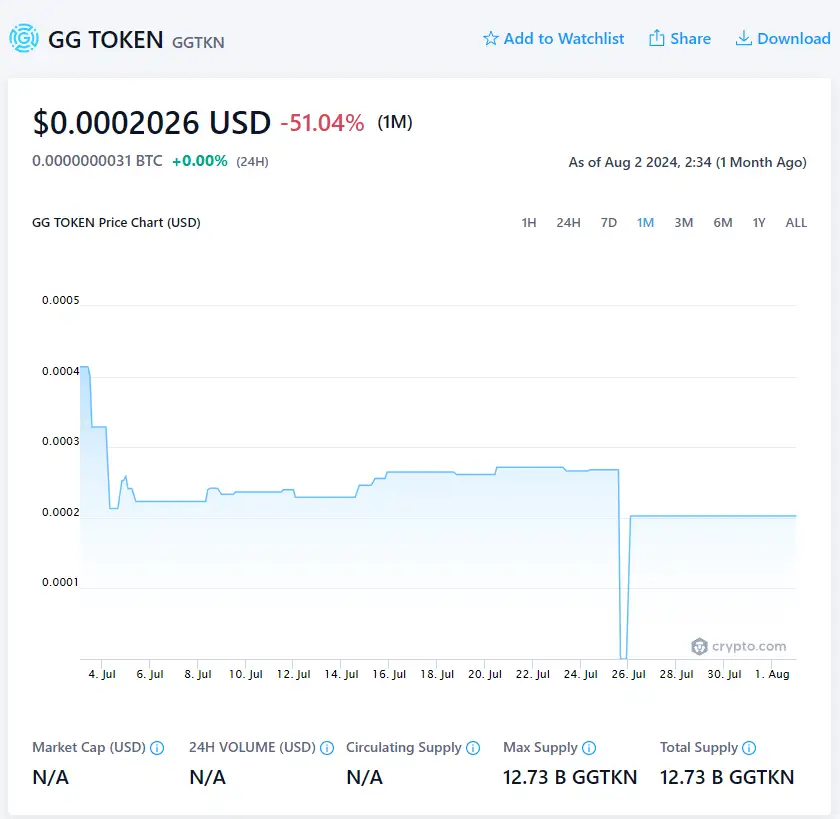

What is GG Token?

How it all started and why on Crypto30x.com GG

In a post from Crypto30x.com GG, the GGTKN is a new token that exists solely in the gaming sector. It was established as a joint project of the companies which operate under the names of GG International, GG World Lottery, and White Lotto with the purpose of changing the concept of gaming. The token has a very large utilization, being the native currency for not only a SINGLE project but for multiple gaming, e-commerce, and networking platform related projects. Some of them are: to develop awareness of blockchaintechnology among populations in Africa, Latin America, and the Caribbean, to act as a substitute to the conventional mobile money solutions, offer bonus through direct incentives and partners around the world.

Blockchain Technology

As a BEP20 token on the Binance Smart Chain, GG Token relies on blockchain to enable transactions that are both rapid and affordable. This choice of blockchain assures users to be able to enjoy fast deposit/withdrawal and other transfer without being charged extra. This token integrates a hyper-deflationary approach that affects the value of the token over the period. With each transaction, a 12% fee is imposed, distributed as follows: A total of 20% of tokens will be issued from the total tokens: 4% to the holders, 4% to the liquidity pool, 2% to the developer and marketing wallet, and 2% to a pump-and-burn wallet. This structure also wants to deliver yield rewards through a structure that does not involve much frictions.

Key Features

The Global Gaming Token or gg token has some special characteristics making it unique in Crypto30x.com GG. It has an extensive practical use in online lotteries – or payment, to be more precise. The token allows investors to purchase lottery or casino projects through WhiteLotto.com at low white label setup fees. The bonuses for the casinos and the sports betting ranges from the deposit bonuses, free spin bonuses, and cash back bonuses. Also, holders of GG Token are given up to 80% discount on all digital and physical products across all e-shops. Another advantage for trading it is that it has a relatively small number of tokens in circulation, which suggest the rate of appreciation in the future.

Conclusion on Crypto30x.com GG

Thus, the world of virtual assets has received a new outstanding creation – the GG Token which connected blockchain with gaming and e-commerce applications. The effects of its key features such as seamless yield production and a hyper-deflationary mechanism play a role on its capacity to generate value in the future. Targeted at everyone who has a computer connected to the internet, the token used for online lottery, for discounts in e-shops, further proves its usefulness. Furthermore, it has linked and conducted transactions with gaming platforms, which led to revolutionaries in the industry offering new transaction and developmental prospects for game and game developers.

Conclusion

Based on these developments and alliances in the future for Crypto30x.com GG and for the GG Token, it looks promising. However, they have some problems: legal restrictions and the lack of efficient ways to increase its popularity among the users in modern saturated environment. With the project’s development over time, the performance of the intervention will be directly dependent on its capacity to avoid these barriers and bring value to the targeted stakeholder groups. Lastly, the GG Token proves that cryptographic currency is still evolving as it tries to integrate itself into people’s daily lives.

Visit Also:- OpenHousePerth.Net Insurance